Day trading has become a popular strategy in the market for financial instruments. It lets traders profit from fluctuations in the short term in price. For those who utilize Ninjatrader having the right tools could be a major factor in the success of trading. This article is a complete guide to Ninjatrader’s daily trading indicators and trade signals, as well as strategies and methods. It’s appropriate for both novice and experienced traders.

Understanding Ninjatrader Day Trading Indicators

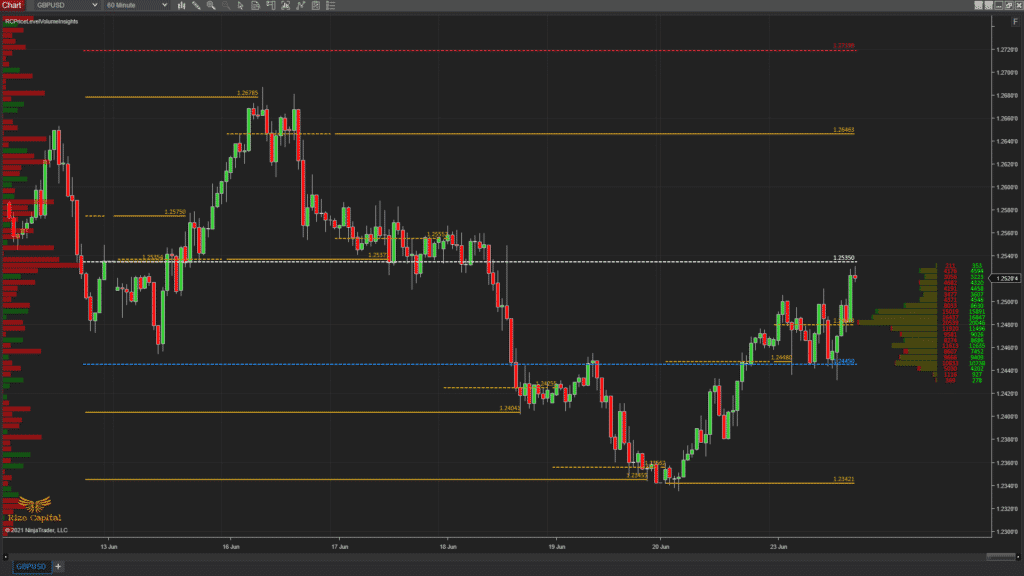

Ninjatrader day trading indicators are vital tools that help traders analyze market data and make informed decisions. They are built on various data sources, such as volume, price and time. Indicators such as Bollinger Bands (Bollinger Averages) and the relative Strength Index (RSI), are very popular. Traders can use these indicators to identify trends, measure the degree of volatility, as well as determine the best entry and exit points.

To stay clear of overloading with information, it is important for traders who are new to the market to begin with a few reliable indicators. Moving averages, as an example are a great starting point as they smooth price data to highlight trends over time. As traders become more comfortable using additional indicators to further refine their analysis.

Ninjatrader Day Trading signals – What are their roles?

Ninjatrader creates day trading signals according to the criteria that the trader has established. The signals alert the trader to the possibility of buying or selling opportunities on the market. Signals are generated by an individual indicator, or a combination of them. This permits an exhaustive analysis.

One of the advantages of using Ninjatrader for day trading is its ability to automate the trading signals. Automating trading signals can reduce emotional bias and make sure that trades are made using objective standards. The traders can test their signals using historical data to evaluate their effectiveness before deploying them in live trading.

Crafting Effective Ninjatrader Day Trading Strategies

A winning trading strategy is vital to make consistently profitable gains. Ninjatrader trading strategies are simple or complicated, based on the experience level of the trader and willingness to take risks. Basic strategies might include using moving averages to identify trends and a stop loss order to manage risks. Strategies that are more sophisticated could comprise multiple indicators, complicated entry and exit rules and automated execution of trades.

It’s crucial to consider the market conditions as well as the objectives of the trader when determining the strategy for day trading. Strategies should be able to adjust to the changing market conditions. For instance, what is efficient in a cyclical environment might not work in a broader market. Reviewing strategies regularly and making changes can assist in maintaining their effectiveness.

Building Robust Ninjatrader Day Trading Systems

Ninjatrader is a day trading platform that combines signals and indicators into an integrated framework. The systems are automatic or manual. The trader can execute trades using signals.

Automated trading systems have a number of advantages, such as increased efficiency, a reduction in emotional trading, and the ability to back-test strategies with rigor. However, they have risks like system failures or unanticipated market changes. It is essential for traders to maintain their systems and be ready to intervene when needed.

Day Trading: Common challenges and solutions

Day trading, though lucrative, does come with certain challenges. Many new traders face challenges due to unfounded assumptions regarding trading, reliance random indicators or a lack of emotional reasoning. In order for new traders to be successful it is essential to know the market and be realistic in your expectations.

Risk management is a crucial aspect of day trading that is successful. Risk capital is money traders are able to afford to lose without compromising their financial security. Making stop-loss orders as well as size of positions can help control risks and protect the investment.

Why you need high-quality trading tools

For day traders, having access to high-quality trading tools is critical. IndicatorSmart offers Ninjatrader indicators as well as systems, signals and indicators which are designed to offer traders with the most efficient resources. These tools are able to enhance the analysis of markets, aid in making better decisions, and ultimately lead to better outcomes in trading.

The conclusion of the article is:

Ninjatrader offers a robust platform for day traders. It offers a range of tools and features to improve trading performance. Through understanding and using Ninjatrader day trading indicators, signals, strategies, and strategies, traders can achieve a holistic approach to the market. The success of day trading is dependent on ongoing learning, adaptation, and the effective making use of resources. With the right tools and a positive mindset traders can overcome the difficulties of day trading and meet their financial objectives.